Welcome back to Wonderland.

This series explores philosophy and political theory from first principles. Please start from the beginning of the series to follow along with the story.

Money makes the world go round, or so they say. Others report it to be the root of all evil, the talk of the town, a substitute for time, or power, but never happiness. Whatever wisdom can be gleaned from all these idioms is rarely universal, for the real meaning of currency is contextual. The rules of our economic system determine if money is better considered to be a weapon or a tool. So what rules should we play by?

What is money? How do you make it? Why does it work? Does it work? Who for? The answer to any of these questions will surely influence your view on the world and your power within it. Understanding the flows and motivations underlying our economic system helps make clear the causal mechanisms that move it in different directions. The ability to steer towards a desired goal is predicated upon our value and incentive structures being in alignment, otherwise we wind up spinning in circles and get swept up in the current sea rather than charting a clear course towards new frontiers.

Cryptocurrency and charter cities could offer an intriguing alternative to insoluble institutional structures, but they must actually be doing something different in order to effect real change. A better state of affairs is within our grasp, if we can properly diagnose the problems of modernity and offer meaningful solutions. That is task this series always seeks to explore.

To start our journey, let’s resume where we left off in Wonderland…

Wonderland is a free publication that outlines a philosophy and political vision for the 21st century. To support my work and receive updates on new posts, sign up for a free or paid subscription.

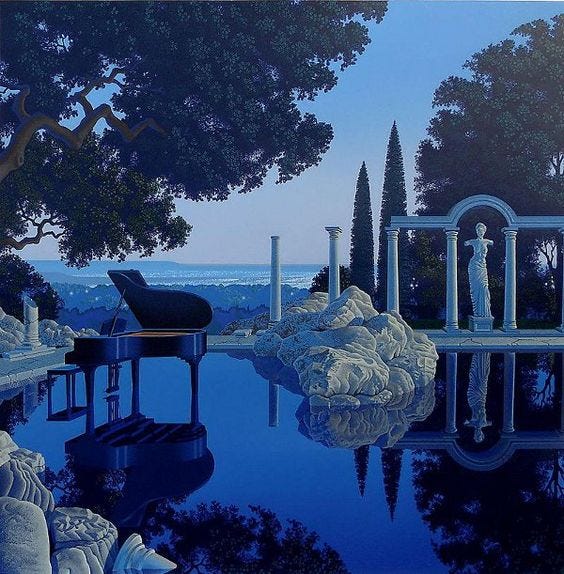

Chapter One: A Roaring Night

At the gate of UM you say farewell to Tru and head south, downstream. It’s twilight, and there’s a chill in the air. You tug your waistcoat into your chest, but it’s thin and the evening breeze goes right through you. Ravens caw overhead, and the trees grow twisted as you venture further into the growing darkness.

The watch around your wrist begins to emanate a low glow, which brightens as the evening turns to night, granting sight of the rocky terrain beneath your feet. Big mouse ears standing at attention, you can hear every crack and snap from within the woods and are ready to flee at a moment’s notice. But no lions, tigers, or bears come calling, and slowly you start to relax and enjoy the journey. The black sky is clear and constellations unfamiliar—you’re a long way from home.

Eventually, you notice something else on the horizon: dark spires stretching up from the murky wilderness and clawing at the crescent moon. They are punctuated with blood-red tips, like talons, which you soon realize are fires lit within distant windows. As you approach the city you encounter a wrought-iron entrance which hangs ajar, the word “Sect” suspended in the metalwork above announcing your arrival.

You nervously creep through dark streets, but the place seems empty. Until you notice the sound of music and catch a whiff of whiskey on the wind. You follow it.

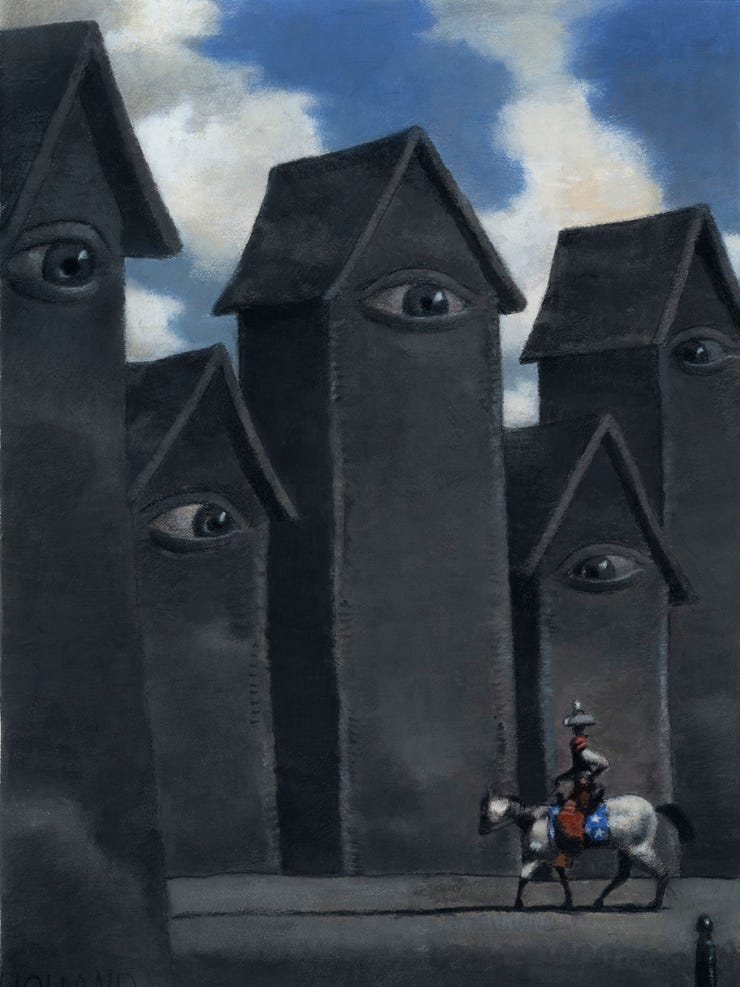

Venturing further into the city you can feel the sense of eyes upon you from just beyond the shadows, leering from the rooftops and peering from the gutters. The inverted panopticon causes your hairs to stand on end, but you see no one.

A clock strikes midnight and you hear a roar erupt around the corner, revealing a tavern that is packed full of people—the source of the sound and smell. You enter the throng and are immediately immersed in thick smoke and song. The bar in bathed in golden candlelight, and everywhere you look is a strange new sight.

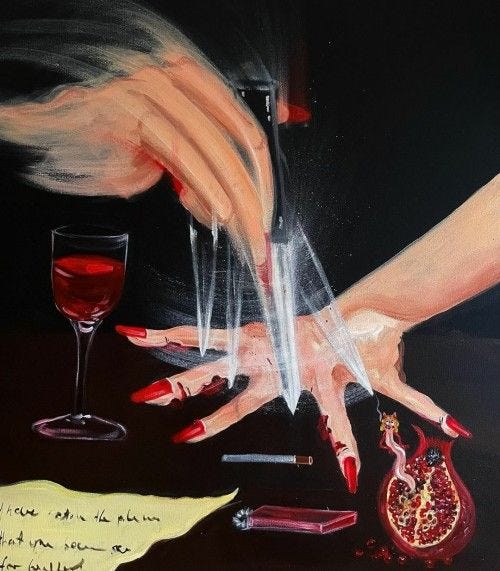

The games have begun. Gamblers and drunks gather round tables to beat their fists in cheer and sneer at strangers. Daggers and coins shine as they dance between nimble fingers, red wine and crimson nails pour across the tables; shuffling cards and dealing with danger. Men with heads of wolves stand whispering in the shadows, while across the room a plump fellow surrounded by slender women puffs plumes of green smoke. A frail man with no face slinks between the crowd, extracting things from pockets of distracted players. Barmaids dance as they sling drinks and sing to soothe the riff-raff.

You gaze around the awe-full room but no one takes any notice of you; a little mouse is nothing strange in a place where everything is peculiar.

Suddenly, a firm hand clamps down upon your little wrist and you let out a squeak. Fat, hairy knuckles raise the arm that your wristwatch dangles from as a big man with black eyes beams down at you.

“Now that’s something you don’t see everyday! Come from the Town of UM, have we? What’s a little critter like you doing so far from home? Run away? Get lost? I’m happy to take this ol’ timepiece off your hands if you’re ready to part ways with it.” His dark eyes glitter as he speaks.

“No!” You yelp, tugging your paw away in fear.

The man chuckles. “Alright, no need to be scared. I know Sect’s a spooky place for someone with your delicate sensibilities, but we’re a reasonable enough lot. No one’s gonna get what they ain’t got coming, that’s our silver rule,” he says, winking.

“I came here for something,” you reply without thinking.

“Yeah? What’s that, mousey?” Asks the man.

“A potion. I need a potion that will turn me into a human again”

He lets out a big belly-laugh that rumbles the floor. “God damn, you’re funny! What else you lookin’ for? ”

“I’m serious!” You squeak, desperate not to sound meek.

He wipes his eyes and gives you a great thud on the back. “There’s only lady in town who can help you with that, the sorceress Sierra. Now that woman is a snack!”

He licks his lips hungrily and then adds, “not cheap, though. You bring much dough?”

This is what you had been worried about your entire journey south, how could you get something for nothing without some good word of mouth?

Chapter Two: Something for Nothing

Section #1: What is Money?

Money emerges as a consequence of trade, enabling more efficient allocation of scarce resources. It is the ultimate improvement of the barter system, allowing people to exchange goods and services across time and place without the need for confluent desires. Money is an abstraction, a symbolic technology that communicates value in lieu of direct demand. It is immanent, an intermediary tool to enable exchange which will consistently crop-up where people have wants. Abolish the dollar and inevitably there will arise other ways to bribe and signal value, be they cigarettes or bottle caps.

In order to work effectively, money as a medium must possess certain properties. To maintain functional utility, money must be divisible, durable, dependable, portable, fungible, and scarce. This is why metal coins have been used so frequently as currency throughout history. The inherent scarcity of gold or silver, coupled with their distinct qualities, makes forgery nearly impossible. The metals can be melted, divided, minted, and distributed without losing the defining features which make them valuable. Stone wheels are cumbersome, sea shells easily shattered, and paper notes prone to reproduction. Without adherence to the aforementioned principles, any alternative currency is bound to be replaced by something better over time.

The necessary elements of a viable money are a product of mere mathematics, they are predictable, and can be deduced from first principles. Without divisibility, spending stagnates, without durability the economy falls apart, without dependability it is untrustworthy, without portability it fails to flow, without fungibility is inconsistent, and without scarcity is rendered worthless. For something to assume a monetary role it must be costly to produce, otherwise the ability to make more of it will destroy any capacity it had to communicate value. People will always prefer hard money, that is, currency which is resistant to inflation or reproduction. Gold, despite its soft exterior, has always been the hardest form of currency because of the high cost associated with acquiring it. The work required to mine a bar of gold is reflected in its value, which has emerged as the ultimate signal of wealth and prosperity across history.

Money acts as a social credit, an “IOU” which allows you to redeem your energy and effort for the work of others. It is only functional if there is an underlying assumption that it will continue to be valued and traded in the future. Faith in the solvency of the social system is required in order to incentivize paying value forward rather than immediately redeeming it for material goods. When you accept money as payment, you do so based on the assumption that you will later be able to exchange it for what you want. Too much uncertainty in the system would make it preferable to cash-out now rather than hold on to something that could soon become worthless. In a time of material scarcity, gold bars would be rendered as useless as credit cards.

Section #2: Signals

The mathematics enabled by prices are essential for money to work properly. Without divisibility, money would be no better a means of exchange than cattle or gemstones. Cutting either in half disproportionately reduces its value. As the wisdom of Solomon teaches us, the worth of a whole is more than its parts. Money is the vital exception to this rule: two quarters are functionally the same as fifty cents. Maintaining fractional integrity allows currency to communicate the nuances of trade more accurately. Negotiation becomes difficult when it is restricted to the limitations of discrete units.

Prices enable precision, causing information and desire to proliferate throughout the economy with ease. The ability to account for supply and demand provides insight into the complex dynamics underlying the generation and distribution of resources. Coordination across various domains with unique drives would not be possible without the capacity to measure and communicate relative value. Twenty dollars could buy you a bottle of wine, simple shirt, or bad manicure depending upon where you go and what you want. The same amount of individual work can be redeemed for many competing assets. Knowledge of these trade-offs allows economic actors to make informed decisions, enmeshing their inputs into a fluid field of potential.

This notion of comparison is essential—dollar signs signal energetic equivalence. Data drives the market by crystallizing abstract transactions into concrete units, which can then be directed towards a specific end. The consumption of resources, time, information, energy, and effort are all arithmetized into a single number, signalling the net and relative value of these many aspects. The multitude of flows required to generate a given good are captured and assigned an objective quantity. Market dynamics are therefore a mere matter of mathematics, which are constantly computing and efficiently reallocating resources towards their most valued state.

Prices instigate this phase-transition, incentivizing creation and destruction in accordance with general demand. Producers and consumers are rewarded for capitulating to these dynamic forces, encouraging energy flows towards optimal outcomes. Mutual dependence means we must induce others to provide for us, and the profit-motive is what encourages cooperation across a vast network of self-interested strangers. Individual actors produce bottom-up self-organization by asserting their values and needs through the price mechanism, causing knowledge to proliferate across the economic system without the need for centralized control.

Section #3: Value Creation

Competition among people for scarce resources is an inherent aspect of reality. Without scarcity, there would be no economics, which is simply the study of how these goods can be organized most effectively. There will never be enough to satisfy everyone completely, for our material desires grow in proportion to what modern culture and technology is capable of producing. Blaming high prices on greed implies that they are arbitrary, but prices are merely an evolved mechanism we use to ration inherent limitation. Time, knowledge, and resources are also in short supply. Markets incentivize the contribution of these efforts by rewarding them with capital, allowing people to receive in proportion to what they provide.

New value is generated through saving, creation, and destruction. Saving, the accumulation of capital, enables people to adopt risk and uncertainty that would otherwise be intolerable. The agricultural revolution catalyzed civilization in a new direction because it introduced the concept of investment and future returns. The nomadic hunter subsists off the land, taking only what he needs in the moment, but never enough to survive the inevitable drought or flood. The ability to withstand future uncertainty is dependent upon present sacrifice; you must toil the fields and store their harvest for later consumption if you wish to create a society with longevity.

Deferred consumption provides the groundwork for industrial production. Savings allow people to invest in the future, forgoing present benefit in favour of later returns. The amount of work required to construct a tractor is immense, but this mechanical innovation ensures that subsequent generations will be able to expend less effort for an even greater reward. Consumption is a dead end in terms of generative capacity, production must be fuelled by limiting the amount of energy used in the present.

Only those with enough capital accumulated to satiate short-term need will be comfortable adopting the risk associated with investment. A financial buffer provides security, allowing people to explore other avenues towards economic growth. The vast majority of our wealth emerges through venture capital, which enables prospective gains by emboldening those who are brave enough to travel into uncharted territory. “Old money” acts as the foundation of our society, passively supporting entrepreneurs and business enterprises by providing liquidity in lieu of active consumption.

Money must be made. One cannot force economic growth any more than they can mandate everyone own a Mercedes. The tools required to generate such luxuries are a product of man’s intellectual capacity. Our creative ability acts as the psychic alchemy which allows us to turn fruit into wine and render iron out of ore. Nature provides us only with raw materials, but the effort of our hands and minds must be employed to discover and distill the treasures from the resources she offers. Cumulated collective knowledge is what raises our standard of living and liberates us from the bonds of imminent need. Invention enables efficiency, optimizing how energy is harvested and distributed. Currently, the amount of raw power a trained athlete could generate from a day’s work is equivalent to around $0.111. Despite a massive surge in production, the cost of raw materials continues to decline as new reserves of resources are still discovered faster than they are consumed.

Section #4: Value Destruction

The market is propelled through a process known as creative destruction. Profit cannot be generated without the associated and real risk of loss. An unsuccessful restaurant will inevitably be forced to close its doors as customers seek preferable alternatives, allowing those productive assets to be redistributed into the economy. One third of all new businesses fail to survive the first two years, and only half make it past four2. Losses signal to producers what to stop doing, while profits encourage an increased supply of what the public wants. With no skin in the game, poor allocation of scarce resources goes undetected and undeterred.

Progress is impossible without growing pains. These losses may be felt by some more than others, but their sacrifice is vital to promote the resiliency of the economy as a whole. Market competition is a collective discovery process, allowing us to approach more optimal organization over time. Pain is what tells us to redirect course and explore other alternatives. Attempts to alleviate the unpleasantness associated with risk renders the entire system worthless—poor choices must be felt and accounted for rather than simply papered over. Reducing efficiency to placate ineffective producers punishes the consumers they are supposed to be serving. This is why excess capital is so essential: it enables misadventures without bankrupting the explorers.

A scarce supply of capital and resources does not imply that exchange is zero-sum. Rather, it is the process of money and material changing hands that allows resources to move towards their most valued output. Any discrepancy between supply and demand can and should be ameliorated through arbitrage. Money represents time, energy, access, and information, meaning it can be made wherever there is room to optimize allocation. The system is only as smart as the actors that create it, and dissonance is bound to erupt where the financial signal has become corrupt.

The drift away from the gold standard and rise of central banking has created an inflationary economy that we are taught is inevitable, desirable, even. The argument being that a steady rise in prices stimulates market activity and mitigates the fear of a deflationary currency. But this fear is unfounded, revealing a fallacious slight of hand; falling prices do not decrease demand, they merely improve purchasing power. Desire is inevitable. The ability to spend less and save more simply motivates long term investment instead of fear-driven panic purchasing and short-sighted thinking.

Section #5: Intervention

In 1913, the Federal Reserve was inaugurated to reduce economic volatility by setting interest rates, issuing bank loans, and managing government bonds. Seeking to create a stable and predictable economy, the Fed must consistently crack down upon the very mechanisms that make the market effective. Intervention in the system only generates new problems which require further regulation to offset. Volatility is a law of nature; uncertainty is what allows complex systems to thrive and grow stronger in an equally unpredictable world. Attempting to counterbalance these forces by tampering with the signal only contributes to more chaos, generating the “boom and bust” cycle that is erroneously attributed to capitalism instead of meddlesome bureaucracy.

We know that human intervention in wildfires only exacerbates the issue over time, and markets are no different. Attempting to suppress natural processes with brute force pushes them towards extremes and actually does more damage. Manipulating the market by contorting the monetary supply obstructs the signal that prices evolved to communicate, making wise assessment and investment impossible. A consistently rising stock market creates the illusion of prosperity while debt is at an all-time high. Printing more currency can stave off the inevitable temporarily, but at what price?

The desire to get something for nothing is tempting, which is precisely why it must be resisted. Spending more than you’re making passes the productive obligation down to future generations, and in doing so destroys the value of saving. Short-term gains come with long-term costs, and a functional society should not bank on future potential to justify present policies. You cannot eat the apples of the seeds planted yesterday any more than you can sleep on a bed made of hypothetical wood. Assuming these assets will bare future fruit is a risky bargain, one that steals from the prosperity of our grandchildren. Eventually it will come time to pay the piper, and the house of cards that has sheltered us from wolfish debt collectors must come tumbling down.

Paper currency, unbacked by gold or other hard assets, holds value only through the muzzle of a gun. The United States dollar relies upon the dominance of the American military to secure its role as the global currency of choice. Faith in fiat is a feat only feasible because of the dollar’s status as legal tender. America’s net debt currently exceeds $97 trillion, while only $20 trillion actual dollars exist in circulation3. This means any value generated by the U.S. economy must inevitably be swallowed up by the treasury in order to offset the debt. If, that is, it doesn’t “make” more money first.

Imagine the global economy is a schoolyard and your brawny big brother is the U.S. military. One day you wish for a snack from the cafeteria but have no spare change. Don’t worry, says your brother. I’ve got you covered. He goes to one of your classmates and asks to borrow a couple dollars. I’ll pay you back tomorrow, he says, and I’ll protect you from that kid that’s been picking on you. Sure thing, says the student, giving him the cash which he hands to you. The next day the same thing happens, and your brother asks another nerd for his lunch money. It’s for my little sister, he explains, she’s really hungry. And you know she’s good for it, she’s always winning cash prizes since she’s a straight-A student. The kid obliges and you get your sweet treat. On the third day the first peer approaches your brother asking for payback. Yeah, yeah, don’t worry, he says. Next week my sis will win the math contest and she’ll pay you then. But just so we’re clear, I don’t like being bossed around, alright? I would hate to see that kid start bullying you again. The cycle repeats. You get your little luxuries and start slipping up in your studies, maybe you don’t win that math contest. But your big brother is a very good mediator, and ensures that none of the other students ever give you any trouble.

Section #6: Inflation

Accruing debt attempts to pull value from the future, with an assumption that this money will be made back at a later date. A credit-based economy allows people to spend more than they’ve earned, raising incomes and imports without the requisite work required to legitimize these expenditures. The consequence of borrowing from the future means that eventually society must produce more than it has consumed to pay for what is owed. But there is no guarantee that the ventures funded by loans will be profitable, and who gets to decide where these investments are allocated? Giving any centralized authority the ability to provide preferential treatment to certain actors allows them to distribute energy they didn’t generate, distorting the financial signal.

Unearned credit creates the illusion of wealth with little regard for real work. Hard money must be made before it can be spent, while soft money can be pulled out of thin air. This trick works well for magicians, but is detrimental for a nation’s citizens. As the monetary supply increases relative to tangible assets, prices must rise, dwindling the savings and purchasing power of the economy’s most scrupulous actors.

Whether the surplus comes from certified officials or criminal counterfeiters it makes no difference, the net effect is the same. Government is the only institution that can steal from you without your knowledge or consent. The securities it issues are backed by the taxes of tomorrow, siphoning profit straight out of your future pocket4.

Inflation is integrated theft, offering a technological backdoor that enables the state to take earnings from unsuspecting citizens. Temptation to control the financial system for personal benefit corrupts political institutions, who leverage their power to harness the population’s productive potential while taxing them for the privilege. Declining purchasing power makes government subsidies and services more essential, promoting increasingly socialized policies and greater reliance upon central control.

Unlike inflation, a deflationary currency creates a sense of prosperity. Everyone grows richer as their dollars buy more today than they did yesterday, making generosity and financial good will more likely. Any two people can create credit and debt based off nothing but a contract, and both benefit from this arrangement. The creditor profits through the interest they earn, while the borrower is enabled to explore new ventures. Loans backed by savings activate latent capital rather than playing with hypothetical gains. Investments should be acquired from those who have the money to spare, as a history of financial success means they are more likely to allocate it wisely.

Section #7: The Rules of the Game

The laws governing any economy are best conceptualized as the rules of a game. Some are fun and fair, encouraging risk, wits and wagers, and strategic cooperation. While others are tedious and tiresome, boiling down to nothing more than the roll of a dice, trivial pursuit, and war. A well-constructed game considers how its various elements interact to produce intriguing or undesirable outcomes, while a poorly made game is one dimensional—it doesn’t provide enough opportunity to experiment and play.

A political system is only as functional as its laws allow. A messy foundation renders participants apathetic, frustrated, and prone to playing by their own rules. When mafia

and monopoly have dominion over the board, people must spend their lives navigating a mind-boggling labyrinth of codenames, trouble, cheats, and internal contradictions. At their wit’s end, without any clue where else to go and operation on the status quo difficult to achieve, it’s no wonder that people resign themselves to go fish or play poker rather than try to win at the game of life. The cards have been stacked against humanity, but a tower that grows progressively unstable must come tumbling down.

Thankfully, better alternatives are both possible and inevitable. The aggravation associated with present-day politics is a sorry state of affairs, but you don’t have to use magic or be a mastermind to soon get a ticket to ride somewhere new. Guess who’s building that for you? The mouse trap of modernity seeks to suppress and coerce those who dare to dream of something greater. But the net allows us to connect for a reason, and some signals cannot be stifled. A patchwork set of new opportunities is on the horizon, and splendor awaits those who have the courage to seek it.

Chapter Three: The Witching Hour

The man you met at the tavern gives you instructions on where to find the sorceress, and you make your way back into Sect’s eerie, watchful streets. Sierra’s apartment is tucked away in an alley a couple blocks west, three stories up and to the left.

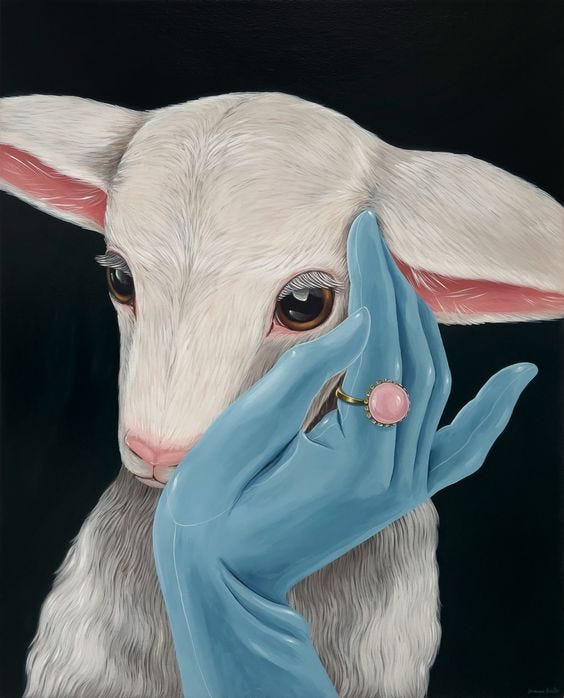

You hesitate at the door before gathering enough courage and giving it a good knock. Moments later it swings open and you are engulfed in a cloud of incense and the sight of a gorgeous woman. She has jet black hair, grey cat-like eyes, red lips, olive skin, and is wrapped in a deep green dressing down. Large gold hoops dangle from her ears and around her wrists, while a bunch of beaded strings adorn her throat and loop her hips.

“And who might you be?” She drawls, taking a puff from a thin cigarette and blowing its blue smoke in your face.

“I, um… I’m not from here,” you tell her. “I came because I was told you could turn me back into a human.”

“I see,” she says, inviting you inside.

The apartment is covered in candles and coloured cloth, which drape against the walls and dangle from the ceiling. The only seating is a collection of cushions on the floor, which she motions for you to settle into. Every movement of her body is accentuated by the tinkling of precious gems against gold jewelry—she sounds like a wind chime. Stretching out across from you, the sorceress produces a sarangi and starts to play. Slow movement emanating from within a pile of pillows catches your attention, and you watch as a cobra slithers out of its hiding place, seduced by the song. You freeze, petrified. The woman smirks and continues to play as she speaks:

“I can make you a human again, if witchcraft is what rendered you like this in the first place. But I never one to give something for nothing. How much gold did you bring?”

“I uh… I don’t have any,” you squeak, embarrassed.

She rolls her eyes, irritated. “Then how do you plan on paying me for my work?”

“I thought maybe there was something I could do for you? In exchange?”

The sorceress laughs. “What could a little mouse like you possibly do for me that I couldn’t get done myself? The people of Sect are not like you UMlings, we cannot live off of simple favours and good fortune. Everything comes with a price. If you want my help it will cost you eight gold coins, you understand me?”

“But I—”

The cobra spins around and hisses in your face and you quickly remember your place.

“Eight gold,” insists the woman. “Don’t waste my time by returning without it.”

“Unless,” she adds, eyeing the watch on your wrist. “There is one thing you could bring me. I need information. I want to know what makes that silly town of yours tick. Where does it take its power from? Riddle me that and I will grant you your potion.”

Sierra rises. “It’s getting late, and I have work to attend to. Return when you have the coin or key I seek.” She shows you to the door and you descend back into the darkness.

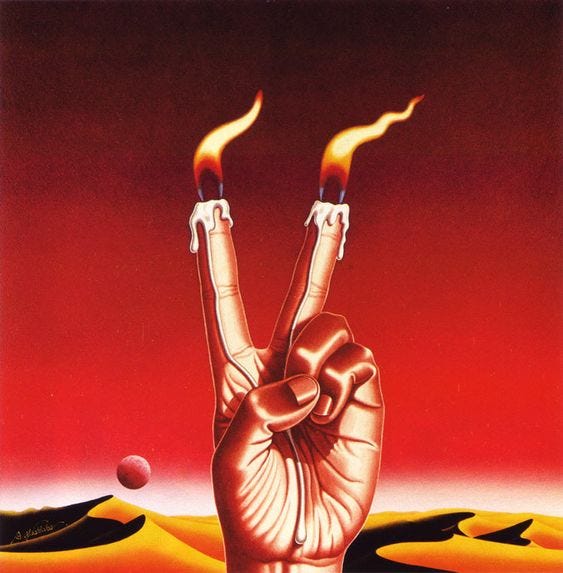

Despite being past midnight, the streets of Sect are livelier than ever. People have flocked into the cobblestone corridors which are now illuminated by red lanterns and filled with merchants selling their wares. The rich scent of food, smoke, and thick perfume fills the air, and strange new strangers are everywhere. Men who walk tigers and carry golden scepters; a tall, thin woman with eyes in her hands; a giant and a dwarf who wrestle in front of a growing, jeering crowd; sword-swallowers and fire-jugglers who tumble through the streets, soliciting spare change from the onlookers.

Mysterious figures shrouded by black hoods linger at the threshold of the festivities, watching silently. Something tells you that these are the same eyes you sensed earlier. Somewhere in the city a clocktower strikes three and a thin veil of clouds covers the crescent moon—the witching hour has begun.

The crowd quiets as the sound of something new fills the air, alien whispers which emanate from everywhere. Rising from the gutters and descending from the rooftops, no two voices are alike. They speak rapidly, tongues waggling expertly as they search for something, like an orchestra finding their tune. Slowly, they start to aggregate around a single sound which swells into song, culminating in a thunderous moment of ecstatic rapture which is deafening. In the silence that follows you could hear a coin drop—the nightly bustle put on pause for the great climax of the evening.

The cloaked figures recede back into the cover of darkness and people return to their business, unfazed by whatever ritual has just taken place. Looking out into the chaos of the city you wonder how it might be possible to make some money.

Chapter Four: Crypt - Chain - Current

Section #1: The Medium is not the Message

In 2008, an anonymous poster by the name of Satoshi Nakamoto broke the internet when he published the Bitcoin white paper on a small cryptography mailing list. Although the profound implications of the technology took almost a decade to receive widespread attention, the world-changing potential of the protocol has been present since its inception. As put by Mark Andreessen: “This is the big breakthrough. This is the thing we’ve been waiting for. He solved all the problems. Whoever he is should get the Nobel prize… This is the distributed trust network that the Internet always needed and never had.”5

So, what is Bitcoin? What secret insight does it have that makes it so darn special? As said by Satoshi himself, Bitcoin is “an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”6 What this means, in the broadest sense, is that Bitcoin is the strongest possible foil to the international monetary system, creating a currency that can flow freely between individuals without relying upon a centralized authority. Through nothing more than data, encryption, energy, and consensus, Bitcoin emerges as the ultimate form of hard money.

It works like this: a new user joins the network by generating a public/private key pair that acts as their digital identity. To receive a payment, the sender writes a transaction that includes the amount of coins being sent and both user’s public keys, which then is signed by their private key and hashed into an encrypted signature. This transaction is then broadcast to the network and incorporated into the next block on the chain. Blocks are created by users who aggregate recent transactions into a dataset along with a reference to the most recent block and a nonce. A nonce is a random number generated to satisfy the cryptographic constraint required to produce a new block. For a block to be considered valid, the generated hash of the data it contains must be below a certain predetermined number, which automatically adjusts given the size of the network. Simply changing one digit in the nonce is enough to make an entirely different hash, and the computing power required to find a number that meets the minimum requirement creates the “proof of work” that Bitcoin is famous for7.

When a successful hash is generated, the result is shared with other users on the network, who then update their ledger to include this new information. In exchange for their work, the block creator gets to add a predetermined number of tokens to their own wallet, thus increasing the total amount of coins in circulation. The block reward is halved about every four years, meaning the final amount of Bitcoins will reach its full potential of 21 million around the year 2140. Transaction fees are also used to incentivize block creators to include a given transaction in the next block.

The proof of work mechanism in conjunction with a peer-to-peer network is what makes the system secure. Nodes will always prefer whatever chain is longest, as it has the most proof of work guarding it. The only way an attacker could successfully hijack the chain is by having more computation power than all the others users. The amount of energy necessary to tamper with previous blocks is greater than what is required to generate new ones, meaning any potential hack would profit more by supporting the network rather than attempting to manipulate it. Through distributed copies of the chain, decentralized consensus emerges, creating a public, cryptographic, immutable ledger of electronic payments.

Section #2: Digital Gold

The value of Bitcoin lies in the fact that it objectifies a philosophical ideal. It turns truth-telling into an automated process rather than an ambiguous assertion. In this sense, the protocol fulfills an obligation that is essential for any successful economy. Bitcoin is the ultimate attractor, a Platonic absolute that pulls the monetary system towards its inevitable teleological purpose as abstraction-made-real. Cryptography creates currency through praxis, entangling the collective cue of value with cold, hard physics. Emerging as the ultimate synthesis of ‘ought’ and ‘is’, Bitcoin territorializes through mere computer code. The symbol and the signal are now integrated, no longer representational but actually doing what it says it is, uninhibited and undiluted.

Realizing the true meaning of currency, this technology must necessarily usurp all lesser signals. Any alternative is bound to be corrupted, inflated, or otherwise manipulated over time. Only that which is immutable can inherently be valuable. This is why so many refer to Bitcoin as digital gold—it adopts the metal’s most desirable qualities while improving upon its shortcomings. It can travel anywhere instantly, be divided infinitely, guarded more easily, and has guaranteed scarcity. Of course, there is nothing stopping others from creating their own version of the program, but first-movers maintain an unassailable advantage over any potential imitators.

The interdependence of the digital network is what makes Bitcoin so secure. Any energy expended attempting to attack the system would benefit more by joining it. Even if a compromise did occur, the prospective value gained would be nullified as the coins appropriated would be rendered worthless. As the price of the currency rises, even detractors will eventually be tempted to invest in the technology so to not miss out on any potential profit—the value of the signal pulls people towards its own end.

The protocol invites participants to play a game of social coordination, producing binding decisions without reliance upon a referee or dependence on prior agreement. Collaboration is neither presumed, or invoked, but produced as a direct consequence of the incentives built into the infrastructure. All players are welcome to cheat. No possible moves are forbidden. Do your worst is an open invitation. This is what true trustlessness means. Without any central authority, spontaneous order emerges as an immanent result of independent, self-interested actors each pursuing their own gain.8

Section #3: An Open Secret

The advent of cryptocurrency introduces the age of the open secret. While the ledger is public and visible to everyone, its participants don a disguise that separates them from their economic activity. Anonymity is preserved through cryptography, masking the identity of those who wish to work from within the shadows. Privacy and property thus become indistinguishable, both protected by a secret key that can produce infinite addresses all leading back to the same place. “Owning” cryptocurrency comes with no tangible assets, only information that allows access to a vault of latent energy.

The only real utility Bitcoin offers is secure documentation, which is enough. Commitment to an irrevocable ledger locks participants in to a system that cannot be revised or reversed. No intruder can compel or corrupt the signal unless they posses the key that enables its flow. Any third party that attempts to control the movement of the currency is powerless against the tide of information. All debate concerning the legitimacy of the protocol is peripheralized as inconsequential to its fundamental nature, which is concerned only with what is; relying upon permission from no one. Waves will erode even the strongest of boulders over time. This is what happens when an unstoppable force meets the immovable “I object!”

The power captured by Bitcoin asserts itself as the ultimate veto of the political process. Governments may try to regulate it out of existence, but as long as there are people who want to use it, it is near impossible to abolish entirely. Bitcoin represents an idea, and an idea once established cannot be killed easily. The currency embodies pure energetic potential, meaning it will constantly subvert any system that tries to capture or destroy it. Bitcoin eludes all institutional interference by way of preference, evading coercion due to the simple fact that the abstract will always seep out and reign

over the concrete. The inevitability of escape is as absolute as Gödel’s proof, pointing out and towards the only real constant: that which is unknown and incomplete.

A network that is open, anonymous, permissionless, and uncensorable is immune to monopoly and manipulation. Freedom from the whim of intervention and exploitation threatens centralized power by allowing value to continually reassert itself outside the boundaries of what is deemed to be acceptable. The influence of the political sphere is downsized, as he who controls the money is ultimately the one who controls the rules. Gold is the original governor of the government, which is why all nations have since abandoned its standard in favour of flimsy fiat. Without accountability to an objective measure of worth, countries can distort market dynamics while citizens stay oblivious.

Section #4: Money Talks

The persuasive power of a promise cannot be understated. The profits offered by prices signal what is most wanted, and the prize for providing these services is riches that can be exchanged for almost any material pleasure. Money makes possible the enjoyment of the best the earth affords, which is why it will always be in high demand9. It is not the universal value, but a universal value, enabling anyone with enough of it to pursue whatever ends are important to them. Because demand always exceeds supply, and money is the medium through which one is converted into the other, its desirability stems from the the unique utility and marketability it confers.

Possessing money allows people to channel energy across space and time, converting dollars into daffodils or dynasties. The ability to exert your will upon the world is an incredible asset, making the pursuit of wealth synonymous with power and prosperity. Force and finance are the two main mechanisms by which power asserts itself, and each can be employed to acquire the other10. Debt collectors threaten prison time or broken limbs, while the rich can afford both bodyguards and contract killers. However neither of these elements may usurp the other entirely, for they are entangled in an endless dance of mutual construction. Attempting to stamp out capital is no more viable than permanently eradicating violence, as the signal of trade will consistently arise in even the most inhospitable circumstances. Currency acts as the ultimate exit, a refusal of top-down control that continually reinvents itself. And when money talks, people listen.

A sound financial system enables the creation of new political structures. Uninhibited by fickle fiat or dependence upon external acceptance, experimental alternatives to the status quo will slowly start to emerge. A government-controlled economy holds power over its populace, while finance-controlled governance has the potential to change the world. The progress of humanity depends upon those whom power does not corrupt. But instead of praying for a miracle, we should hold institutions accountable by paying to align incentives through the attractive promise of profit.

The ideal economic system must exist outside of and pull political levers rather than being beholden to them. The most prosperous societies throughout history were all a product of the gold standard, which kept kings in check and assured they never spent more than they had in store. Capitalism can only create change if the people are free to spend and save as they see fit, otherwise corruption and privation run rampant. The specific form of government actually matters less than the economic foundations it is built upon. So long as the financial system is sound, both feudal lords and fascist dictators are forced to answer to their treasury’s balance sheet and therefore cannot compel what they have not earned. All leaders rely upon support from their citizens to sustain their reign, so why should the public give more than they get in exchange?

Section #5: Flows

The free market is constructed out of streams of information known as currencies, or current-signs. All that is solid melts into liquid wherever money touches it, that which is no longer valuable is dissolved, distributed, and assembled into something new11. Competition is key to a market economy because it draws prices towards equilibrium and causes capital, labour, and resources to flow towards their highest rate of return. Much like water seeking its own level, this does not imply that the ocean’s surface is smooth; waves and tides are an essential part of the process12.

Money acquires utility through liquidity, allowing latent energy to trickle and spread throughout the economy effortlessly. As a social technology, currency circulates in accordance with human desire, which fluctuates depending upon the contextual needs and values of the time. There can be no fixed, ideal end state because the environment is constantly changing and evolving, as are the people who inhabit it. Like all complex systems, continuous adaptation and reorganization is essential for its survival, generating an architectural principle that is both watery and robust.

The teleological question, “what is happening?” is overshadowed by the ever-prescient unfolding. What is now is less interesting and less important than, “what is it becoming?” Present irrelevant, destiny is indeterminate. Capital flows along a firm path with no final destination: the course is its only product. Tension between cascades towards pools of equilibrium and swirls of excitation pulls the system along a diagonal. It tends towards neither chaos nor order but always between these two extremes13. Constructing and deconstructing in equal measure, hurricanes and thunderstorms are both integral to the process, but where they lead exactly is an ever-insoluble mystery.

What we do know is that systems gain value from network effects. Intelligence takes the form of error-correction, shedding all that is undesirable or no longer sustainable. What emerges from the cloud of economic activity is a form of intelligence far greater than the sum of its parts. No individual could create a computer out of raw material, never mind a skyscraper or biology textbook. Yet these things are a dime a dozen and seemingly fall straight from the sky due to nothing more than market dynamics and the resonant call of capital.

Section #6: Fix the Money, Fix the World

Broken monetary systems beget broken outcomes. When currency ceases to be the means by which men deal with one another, persuasion through coercion or violence becomes the only alternative. Controlled economies can make the same mistakes indefinitely without facing any consequence for their inefficient allocation. Only the citizens suffer, as quality of life diminishes due to the signal of need and desire being stifled. Government officials can waste tax dollars and impose crude regulations while never being held accountable for the negative influence of their ineptitude. Political opposition will always be scapegoated for the failure of pernicious policies, and more intervention is invariably the only solution.

With no incentive to consider what trade-offs are actually worthwhile, unelected and financially illiterate bureaucrats can impose their whims upon a helpless population. Decision making power is centralized to a select few who have a limited view on future potential. Instead of capital disseminating from the most productive and prudent members of society, private bankers and politicians posses the authority to manipulate the system in favour of their own arbitrary preferences and personal gain.

Additionally, the absence of a gold standard or modern alternative means that there is no way for citizens to protect their savings from depreciation. Current economies exacerbate wealth inequality because inflation disproportionally effects the poor. Without the time, knowledge, or ability to shelter earnings in stocks or other assets, the purchasing power of those who need it most slowly dwindles to zero. Anyone who isn’t investing is actively losing money, creating extra work that few people have the bandwidth for. The financial system is far too complicated for the average person to navigate successfully, and implicitly favours the wealthy while penalizing those who do not have the resources required to do anything differently.

What we need is a currency that appreciates in value over time instead of punishing society’s most vulnerable members. As luck would have it, Bitcoin fixes this, offering an international store of value that cannot be corrupted or controlled. Universalizing access to a reliable medium of exchange allows anyone in the world to participate in a sound financial system. Over time, liquidity will coalesce around whatever states manage their economies most effectively. Market mechanics can be used to finance both competitive and communal structures. Individual preferences are best organized around a common attractor, and money is the ultimate instigator. Even if a penny-less society is the stated ideal, capital is still required to acquire territory and commandeer the necessary supplies to sustain growth.

Governance originating out of a sound economy is motivated to manage public funds and resources more responsibly. The need to match expressed ambitions with tangible results encourages political administrators to summon the best possible information and orchestrators. Efficiency and efficacy must be prioritized as incompetence will be punished by unsatisfied citizens simply moving elsewhere. To create the conditions for true political agency and lasting vitality, consent is key.

Chapter Five: Watch Out

“Hey mousey!”

A familiar voice calls your attention and you whirl around to see the man you met earlier—he’s gotten considerably more drunk since you last saw him at the tavern. Face flushed and puffy, his arms are wrapped around the waists of two thin women. One is black as night and the other pale white, both adorned in sheer red silk that shimmers in the moonlight.

“Boy, am I glad to see you!” The man booms. “You’re my lucky charm, you know that? As soon as you left I went on the best winning streak of my life. These two ladies have you to thank for my stellar company,” he squeezes their hips tightly. “The name’s Will, by the way, but I tend to go by Bill. Let me buy you a drink, my little friend.”

“Thanks,” you squeak. “But I need my wits tonight. I’ve got to find a way make eight gold before daylight.”

Bill bursts out into laughter and his two companions giggle softly by his side.

“Eight gold! Most men would be lucky to make that in a month. That charmer really drives a hard bargain, now doesn’t she? Any chance you know how to spin straw? Or pick locks? Maybe you could try to catch that golden goose they say is running loose.” His mouth waggles in a sardonic smile.

“Tell you what, mousey. I’m in a generous mood tonight and could give you a couple gold for that there wristwatch of yours, but the rest you’ll have to earn on your own.”

You eye the silver watch on your wrist and contemplate the odds that you’ll need to it get back into UM. What if it winds up in the wrong hands and is used it to infiltrate the city? You recall the opal necklace worm by Meera that allowed her to slip in, undetected.

“What do you want it for, anyhow?” You ask.

“I’m going to smash it open.”

“What! Why?!”

“For the key, of course! The secret key that’s hidden inside. I’ve always been curious what makes that tiny town of yours tick.”

That’s exactly the same thing Sierra said to me, you realize, gears turning.

“How about this,” you say. “I’ll let you take a crack at my watch for free if you let me keep a copy of whatever key we find inside. Is that fair?”

Bill beams, breaking away from the two ladies to clamp your small paw in his strong hand and give it a shake.

“Deal,” he declares. “Come with me, my workshop is just down the street.”

In a small underground studio the two women sit chatting quietly on a sofa while you and Bill hunch over a workbench. He’s put on a small pair of spectacles and is using an assortment of tools to slowly pry open the opal watch face. As he works you ask him about the mysterious hooded figures you saw earlier that morning.

“Those are the Tellers,” he tells you, pulling out a screw.

“Every night at the witching hour they gather to share the inner workings of the day. They are always watching, tucked away in the shadows, listening to the activities of the city. Then they assemble under the cover of darkness to share whatever it is they have witnessed. They speak in tongues in a language only the others understand, and once they are all on the same page they disperse again. That’s how they’re so powerful.

By spreading information amongst themselves they absorb the underlying motions and mechanisms which govern Sect and learn to predict the future. Then they sell that knowledge to others by operating as oracles and fortune tellers.”

“It sounds sinister, but to be honest, they’re what keep this place running smoothly. Without them, anyone could break the silver rule without being discovered and Sect would be no better than those thieving Thucks in Thumb.”

“What’s it like there?” You ask.

“Under the rule of Thumb, anything goes. Might makes right. You might think this place is bad but trust me, you ain’t seen nothing yet. In Thumb someone could turn that pretty white pelt of yours into an area rug and no one would bat an eye.”

“I think I’ve got it!” He exclaims a few minutes later. The watch springs open and a tightly wound string of irregularly perforated steel pops out. Gently, he unravels the thin sheet of metal and threads it through a peculiar-looking music box.

“You want to do the honours?” Bill asks, offering you the tiny handle.

As you turn the crank a stream of words trickle out which he scribbles down eagerly: Awaken, Being, Carry, Deliver, Elucidate, Fix, Guard, Hail, Indicate, Judge, Know, Lead, Melt, Nurse, Object, Perceive, Quest, Receive, Serve, Timeless, Value, Wind, Yearn, Zero.

“That’s it,” Bill breathes, staring down in awe at the sheet of paper.

“This is the key to the city.”

Chapter Six: “Good” Fortune

Section #1: Market Manipulation

Despite good intentions, many government interventions in the field of economic activity actually produce counterintuitive, if not outright disastrous outcomes. Rent controls, price ceilings, floors, and subsidies tend to create more of the exact issues they were designed to mitigate. This is because causation is a two-way street; attempts to reduce congestion can actually contribute to more people trafficking in exactly the same problems that were sought to be solved.

Poorly contrived incentive structures lead to feedback loops wherein interactions between agents generate epiphenomena with their own agenda. Individual intentions matter less than the broader systems they are embroiled in. The study of economics is concerned with what emerges, not whatever public good is being encouraged. Broken rules bring about bad results which cannot be blamed on any players in particular, people simply respond to signals in pursuit of their own self-interest.

For instance, rent controls designed to make housing more affordable instead reduce the supply of new living spaces while increasing demand due to artificially low prices. Potential construction projects or room-leasers have no reason to put their product on the market when the relative profit for doing so has been minimized. Meanwhile, the quality of current housing declines as landlords are given no motivation to improve the value of their units. Apartments deteriorate while housing turnover slows to a standstill as those fortunate enough to be locked-in on a good deal have no reason to downsize to something more economical. In fact, the wealthy benefit most from these policies as they incentivize the creation of only more expensive condominiums.

Price controls distort desire, making less available to those who need it most. In New York City, there is four times as many abandoned housing units as there are homeless people. But it’s more profitable for landlords to simply let these assets sit idle than spend resources managing the property when doing so would hurt their bottom line.

Mandating that anything be disingenuously affordable causes it to be wasted as its real value is no longer reflected. Instead of encouraging thrift in the face of scarcity, those who come first gain full advantage of the policy while latecomers get nothing.

Rising prices increase supply and promote efficient allocation while artificial ceilings simply cause less to be produced. Insisting that dental or health care does not fall above an arbitrary amount reduces the potential for profit and subsequent innovation in the field, which helps to everyone. Industries with no controls in place see the rapid development of new technologies and thus are able to serve more customers, whereas prices distorted in order to enforce what “should” be tamper with the market signal in favour of misguided attempts at coercion and constraint.

Manipulating the economy in the name of social good does the populace a disservice. Price floors introduced to appease producers only contribute to surplus and waste, even in the face of objective demand. During the Great Depression, piles of food went to rot while mass starvation ran rampant. Tax dollars used to subsidize farmers were also used to feed the poor, who could no longer afford what they helped pay to inflate. Contradictory inefficiencies created by such policies are economically disastrous but politically sly, as now both parties must rely on state support to continue the charade. What is taken in one hand is given by the other, with the cruel irony being that “help”

from the governing body was never needed in the first place.

Section #2: Sin City

Even in an environment unfettered by external control, unexamined desire alone is not enough to create a prosperous society. Sect’s silver rule symbolizes the laissez-faire libertinism that is considered synonymous with free market capitalism. However, the call to creation and particulars of construction are not the same. Evolution simply instigates an ever-unfolding process, and some adaptations are more attractive than others. Forms that gives rise to dysfunction are unsustainable, they are “unfit” in that they fail to fulfill some essential purpose. They miss the mark.

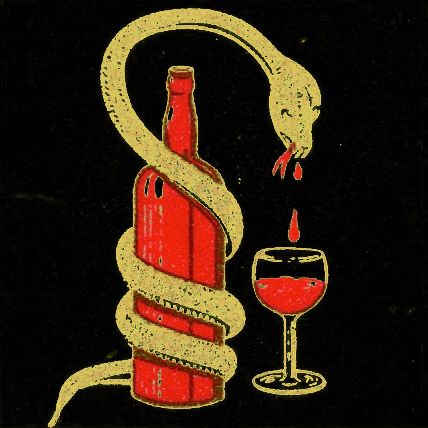

Profiteering from sin always induces rightful indignation. Making money through lust, greed, gluttony, sloth, wrath, pride, or envy all abstract value away from its true source. Vices approximate the feeling of something meaningful but are fickle, misguided, and therefore worthy of condemnation. This doesn’t imply they should be outright forbidden, but understanding the relationship between sin and false profit will help make clear why they will never pave the way to good fortune.

Lust takes the form of prostitution and pornography, providing access to an unearned source of stimulation and intimacy. Without the need to attain sexual satisfaction through the seduction of good character, men have little reason to better themselves or engage in the fruitful complexities of a real relationship. This severance devalues women as a consequence, who are reduced to nothing more than a nuisance now that their male counterparts can get their primal needs met far too easily.

Greed takes the form of gambling, where the thrill of financial reward comes without the requisite hard work or foresight. Gains garnered through the monotony of a slot machine or simply scratched off of a lottery ticket tend to be squandered more easily, as no real thought or effort was required to obtain them.

Gluttony takes the form of processed food and factory farming. Designed to be as addictive and irresistible as possible, these substances artificially induce satisfaction through chemicals while rendering us more fat, malnourished, and hungry than ever. Animals raised in horrific conditions to be slaughtered with maximal efficiency are no better, producing products that are far less satiating and soaked in needless suffering.

Sloth takes the form of those who exploit systems for gain while providing nothing of value in exchange. These swindlers will lie and cheat by finding loopholes and fools they can take advantage of. Scam callers, pyramid schemers, and snake-oil salesmen all fall into this category.

Wrath takes the form of bullies who use threats and force to acquire access to the undeserved. A manipulative manager or blackmailer abuse the power they hold over others to exact control and financial benefit from those too vulnerable to resist.

Pride takes the form of copyright and patent laws, which create artificial scarcity and monopoly over ideas that truly belong in the public domain. Innovation and progress is stifled in favour of fuelling the egoic attachment of those who erroneously believe inspiration to be a zero-sum game14.

Envy takes the form of knock-offs and counterfeits, which mimic the success of others while offering no superior quality or originality of their own. While false shortages are undesirable, cheaply made imitations are no better. Aside affordability being an asset, mere replication of a popular brand or business overlooks the opportunity offered by one’s own distinct vision and skillset.

Sinful enterprises are short-term solutions to deeper questions of meaning and desire. Brutish answers may satisfy and garner profit for a season, but they ignore the need for a more genuine understanding of what creates value and how it can be generated. Making money through vice is spiritually corrosive and socially unsustainable. Our inherent longing for that which we know to be good outlasts any fleeting gratification derived through symptoms of virtue divorced from their true cause.

Section #3: The Virtue of Selfishness

Notably absent from the list of cardinal sins is self-interest, or the pursuit of personal desire without regard for the opinions of others. Money is an incredibly effective tool for getting you where you want to go, but it will not replace you as the driver. Any tool can be turned into a weapon if used in the wrong way. The free market is guided by nothing more than human action, and no amount of wealth will buy happiness for he who has no idea what it is he truly wants.

Spending money is a grave responsibility, as you are giving energy to the creators of whatever it is you choose to purchase. Therefore buying products that are antithetical to your ideals is a moral evil—you are supporting your own destroyers. Drugs, junk food, and pulp fiction is fine if seeking an occasional guilty-pleasure, but become detrimental if using them turns habitual while going against your better judgement. Currency is a signal of value, and you inadvertently generate more of whatever it is you give fuel. Markets are only as functional as the people that form them, and will be rendered perverse or prosperous in accordance with their aims of their actors.

A free economy will easily drift into whim if not anchored by agents seeking their own self-betterment. Laissez-faire without a grounding moral principle devolves into hedonic cynicism, which is poison to the greater purpose of the soul. This is why rational self-interest is the necessary precondition for political liberty. Carefully considered consumption is required for a city to thrive, lest it be reduced to the reckless pursuit of mindless indulgence and needless extravagance.

Independent purpose arises through conscious awareness. Without interrogating why we want what we want, we are bound to follow the madness of crowds and chase signals of value rather than their real cause. What constitutes “good” reason poses a philosophical question, one that can be answered by no man other than himself. Our calling is a product of our nature and potential, and not all people should pursue the same path. Understanding our unique vocations, abilities, and affinities is essential to guide individual action in a positive direction.

When market incentives and individual aspirations are both properly oriented, selfishness becomes inherently virtuous. Profit-seeking turns into good fortune for all, as there is no contradiction between private ambition and public need. The positive feedback loop between collective value and personal benefit pulls the two forces into progressive alignment, until they can essentially operate as a single unified entity.

Section #4: The Value of Virtue

Those who don’t respect money will struggle to acquire it, for they fail to apprehend the value it signals. Those who fear loosing it are stuck in a similar position, for they doubt their ability to generate more of it. The man who damns money has obtained it dishonourably, while he who appreciates his fortune has earned it well. Many people lump into the same category all who have become wealthy, refusing to consider the essential question: the source of the riches, the means by which the wealth was made15.

Some people get-rich-quick through sin, or by benefiting from the many faults of our current financial system. While others work tirelessly their entire lives and still retire without a penny to their name. It’s a shame that virtue isn’t always rewarded right away, but the underlying value it carries triumphs in the long game. Short-term gains cannot outlast the consistency of integrity, even if the pattern take a few generations to emerge. Capitalism will never look like a fair system when examined on too narrow of a time horizon—early advantage, good luck, and bad fortune cannot be mitigated—but the lessons we pass on to our grandchildren survive us all.

New immigrants might toil eighty hours a week to set their family up for success, while the average college graduate works half as hard for four times the income. But comparing these two demographics is disingenuous; it ignores the broader historical context that created them. Personal progress and quality of life improvements matter more than interpersonal comparison. Children of immigrants tend to be more driven, while those born into privilege are never taught to have a strong work ethic. The values we learn, be they honesty or thrift or diligence, these are the traits that come to define our life trajectories. But the results are not immediate—patience is a virtue too.

Money moves, but it doesn’t move first, it flocks towards those who shepherd it wisely.

Sometimes it gets caught chasing its own tail, but these cycles eventually run out of steam over time. With no new sources of energy, or information, all systems tend towards entropy. The creation of wealth is a constructive process, generating order out of chaos and reducing the amount of uncertainty in our daily lives.

Values are the ultimate organizers of reality, representing a fundamental inversion of causality. Morality brings the material world into existence, not vice-versa. Certain patterns of behaviour are consistently selected for precisely because they are virtuous, they are in some divine sense superior to any alternative. The matter of the universe sustains itself by approximating these heavenly ideals, which humanity then spreads through the power of story and religion. Mythology is essentially data compression16, compacting millennia’s worth of collective wisdom into something that is memorable and timeless. When we act in accordance with these teachings, their fruit is bountiful.

Moral relativism is therefore indefensible. Pretending that concepts like Goodness, Virtue, and Truth are mere matters of individual preference ignores the mountains of evidence to the contrary. Appeals to faith or a higher power are not necessary to be persuaded, for the results speak for themselves. Modern nations have grown wary of asserting standards of good conduct and do so to their own detriment. When calls to virtue are shed in favour of easing the ill effects of our worst impulses, there no longer is an impetus to grow and get better. The ability to mindlessly bail out bad behaviour is the luxury of a society that has lost touch with the true origins of its wealth.

Section #5: Safe and Sound

An inflationary currency creates negative psychological consequences. Rising prices increase perceived scarcity even in a climate that is growing more prosperous. This amplifies divisiveness and contributes to needless conflict and uncertainty. Unsound money reduces cooperation between countries because it distorts the signal of value, turning trade into a political issue and provoking animosity between nations instead of uniting them in pursuit of a common goal. The military-industrial complex relies on the generation of fiat, which fuels and incentivizes participation in endless war17.

Hard money, on the other hand, enforces the prudence of peace because the cost of conflict is experienced immediately. The government can only afford what it already has saved, putting a hard limit on combat while promoting better tactics and more ethical alternatives. Reliance upon upfront taxation restricts the state’s reign to what its populace deems desirable, and people are much more willing to finance their own protection than they are arbitrary expansion or foreign intervention.

A sound financial system encourages mutually beneficial relationships by making explicit the underlying interdependence of the global economy. Trade grounded in a shared store of value induces peaceful coexistence by giving nations a vested stake in each others prosperity. As global productivity rises, prices will fall, reflecting the true prosperity of society rather than inciting senseless fear and hostility. The increase of knowledge and technology spurred by us sharing resources should naturally reduce political tension and rivalry. Friction is only introduced when the real fruit of our labour is shrouded by a false alarm.

When money depreciates in value, people are incentivized to become more short-term oriented. Why would you save for the future when spending today is guaranteed to get you more? People always prefer present over deferred consumption unless you give them a good reason not to. In terms of the classic marshmallow test, inflation offers a child one marshmallow now or half one later, turning self-control into a disadvantage. With no motivation to delay gratification, people are sure to spend frivolously instead of saving for something better. Producers are likewise influenced to reduce the quality of their product rather than raise their prices, which will surely lose them customers. Under the rule of fiat, instant returns and poor taste prevails as there is no impetus to invest in a better tomorrow. Art and architecture become crude, cheap constructions as notions of beauty and longevity regress to be nothing but relics of an ancient past.

Only through the firm foundations of gold have great monuments and works of art been made historically possible. Renaissance painters and colossal cathedrals were all financed by wealthy families seeking to preserve their legacy. When savings appreciate

over time, people begin to prefer quality over quantity and become more discerning in how they wish to allocate their earnings. Deferring consumption in favour of future reward does not lead to stagnation, as modern economists would like you to believe, because the savings of the past become the spending of today. Sound money allows people to invest in others while risking less themselves, producing a passive income that encourages prudent purchasing and a culture that is oriented towards future success. Both in terms of wealth and war, the hidden cost of unsound money makes the price of mining gold or cryptocurrency minuscule by comparison.

Section #6: The Golden Rule

The only challenge Bitcoin faces in becoming the de facto money of choice is its volatility. A consistent supply and variable demand means that Bitcoin is generated at a constant rate, irrespective of market forces. Given that it is a new technology, desire for BTC will fluctuate in accordance with excess savings and its current cost, creating a feedback loop. The only way to avoid being swayed by these oscillations is through understanding the currency’s actual value proposition, regardless of how others react. The price of any store of value will vary due to a multitude of environmental factors. Security comes through their scarcity and durability, not the whim of market mayhem.

The cost of transacting on the Bitcoin network means that it works best as a means of saving, but is ineffective for handling hundreds of thousands of daily exchanges. Second-layer technology built upon the blockchain is needed for it to scale properly, which is where other platforms like the Ethereum’s “smart contracts” come in handy. For a new economy that wants to take advantage of hard money while maintaining frictionless flow and reducing price fluctuations, a new currency backed by both gold and Bitcoin could be optimal.

Gold offers stability and a long history of global marketability, while Bitcoin captures the growth and potential of the digital era. An amalgam of two would be more reliable than either in isolation, leveraging their advantages while evading the shortcomings of total dependence on a single store of value. It’s also convenient that, as of writing, their peak prices have both been around $65,000 USD and will very soon surpass that. Combining their financial fortitude in an 80/20 ratio of Bitcoin to kilos of gold bullion would render a currency that is both sound and soluble, allowing information to flow freely through the economy while maintaining integrity through a solid standard.

Prospective citizens would attain access by providing the national treasury with either of its reserve currencies. Accepting only Bitcoin or gold as payment establishes what standards the state takes seriously, namely, a rejection of anything that lacks firm foundations. Citizens would have the ability to trade in any currency they choose, but participation in the system would be contingent upon providing it with its personal vision of value. Residents could protect their savings in whatever assets they prefer, while converting some amount into the cities native coin for ease of daily exchange, knowing that at any time they can be redeemed for the gold and Bitcoin they contain.

The utility of a local currency backed by hard money will soon become apparent, as this new signal would also come to contain the emergent prosperity of the city itself. Although not intended as a long term store of value, this quality could arise over time as the state proves to be successful. Symbolizing the inherent value of the economy, this could eventually make dissolving the token back into its constituent parts less profitable than simply preserving the sign of prosperity and good governance, creating economic alignment between citizens and the city’s future potential. Initial members would likely only acquire small amounts of the token at a once due to valid concerns over the longevity of the new system, but as it becomes lindy, even foreigners might invest in a stake of the city without ever stepping foot inside.

Instead of hiding its gold in reserves, out of public sight and mind, why not put this symbol of vitality on display for all to see? The connotations of this precious metal speak for themselves, and should be speckled throughout the land as a feature of strength and spectacle. Embedded in public monuments and architecture or minted into coins that are actually worth their face value, gold is something to be cherished, not stashed away and deprived of its radiance. A real gold coin, embedded with Bitcoin, would be a novel attractor to the city and impart real utility by acting as a unique gift or tip for excellent service. The digital era lacks the convenience of cash, which can be a useful tool for handing out physical tokens of gratitude and good will. The value of these coins, inherent and ever-increasing, would become a souvenir of economic sovereignty and incite curiosity about the place where money has real worth.

Section #7: Data Drives

A cryptographic wallet could easily be synthesized with a physical, fingerprint-activated accessory that would allow citizens to move and transact seamlessly throughout the digital and physical world. This device would act as a key to the city, replacing all need for a physical ID, credit card, house key, cellphone, or hardware wallet. Not only would this remove our frustrating system of PINs, SINs, plastic cards, two-factor authentication, and password protection, it would also let people manage multiple identities, or opt for total anonymity.

Chaining identity to a removable store of information would allow people to alternate between “me” mode and “node” mode. For some circumstances you want your actual self to be associated with your activity, while in others a mask or tech-free meat suit is preferable. In a city of the future, driven by data, the degree to which you wish to be perceived or recorded varies and should not be made permanent. The ability to slip between modes would let residents regulate how much attention they are receiving and choose if they would rather have better protection or less detection.

Your primary, public wallet would be associated with your face, name, address, and other essential aspects. Any financial assets stored to this account would be insured against user error or theft and taxed a small premium for the added protection. Only explicit savings would be eligible for government security and intervention. All deals made through separate avenues would be your own business. Still fully lawful, just not rectifiable through legal proceedings should something go awry.

By connecting people with an objective measure of action and store of value, new incentive structures become possible. Charity is easy when energy flows freely. In fact,

it becomes costly not support your fellow man, because you all share the same system. But free lunches need not be handed out indiscriminately—duty comes first, and a collective chain of command can signal what causes most desperately need support. An artificial intelligence could easily coordinate this call, efficiently optimizing gaps between an individual’s ability and general demand. Drawing those without purpose towards actionable service provides them with a sense of achievement and personal betterment. Encouraging prosocial activity helps the city while gamifying productive action in the process, allowing you to play to pay for what you want by giving back to the community. This miracle of merit is what makes the Town of UM so hospitable and successful: they know that new sources of value are always waiting to be unlocked.

Chapter Seven: Unlocked

You scurry back to Sierra’s place as face as your little feet can carry you. The sun has started to rise, bathing the spires of Sect in soft purple light. The streets are empty again, littered with dirt and debris from the events of last night.

Rapping firmly at the apartment door, you get no answer. Worried that you’ve lost your chance you knock again, harder. Eventually the door opens and Sierra stands before you, scowling. She is wearing a violet nightgown, black hair in a messy bun

“I was sleeping,” she groans. “This better be good.”